Get ready for a major development in the world of cryptocurrency. Mt. Gox, a once-popular Japanese exchange that has since shut down, is about to distribute a whopping 140,000 Bitcoins (worth around $4 billion) to its creditors starting from October 31, 2023. This news has the potential to significantly impact the Bitcoin market, possibly pushing it into a bearish phase if there isn’t a strong rally by the bulls.

The repayment process will begin with the eligible creditors receiving their share of the debt. These creditors fall into three categories: those entitled to Base, Intermediate, and Lump-Sum Repayments.

This distribution of such a substantial amount of Bitcoin could have far-reaching consequences for the cryptocurrency landscape. Investors and enthusiasts alike will be closely watching how this event unfolds and its implications for the overall market. Stay tuned for further updates as we keep an eye on the ever-evolving world of Bitcoin.

Repayments: The Impact on Markets

The repayment process for Mt. Gox’s creditors has hit a snag due to changing global regulations, making it difficult to determine the exact timeline for repayments. The Tokyo District Court holds the authority to potentially extend the deadline. Nobuaki Kobayashi, the bankruptcy trustee overseeing the proceedings, is responsible for distributing approximately 141,686.37 BTC to around 42,000 creditors.

In January, Kobayashi announced that rehabilitation creditors would need to submit the required documents at the exchange’s head office to register for repayments. Depending on the announcement made earlier this year, some creditors might receive their repayments in cash while others could opt for Bitcoin Cash.

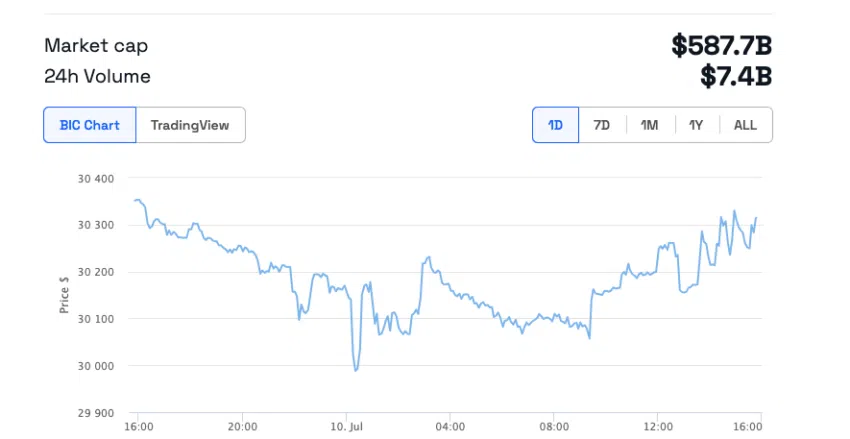

However, the market might experience a negative impact if there is a significant sell-off, as it could potentially cause a drop in the price of Bitcoin. The ease with which Mt. Gox creditors can liquidate their cryptocurrency holdings will play a crucial role. Experts and traders within the Crypto Banter community are closely monitoring Bitcoin’s performance, as it is currently at a critical resistance level that could sway bullish or bearish depending on the behavior of the bulls.

If the market turns bearish at this juncture, a substantial sell-off from the Mt. Gox creditors could further exacerbate the situation.

Mt. Gox, launched in 2010 by Jed McCaleb, used to handle more than 70% of all global Bitcoin transactions before shutting down in February 2014. Initially, it closed its doors due to allegations of millions of dollars’ worth of BTC going missing. Subsequently, the company filed for bankruptcy protection. Jed McCaleb later co-founded Ripple Labs, another prominent player in the cryptocurrency industry.

Japan Takes the Lead in Global Crypto Regulations

Following the infamous collapse of Mt. Gox, Japan emerged as one of the pioneering countries in establishing regulations for the crypto industry.

In the aftermath of Mt. Gox, cryptocurrency exchanges are now required to register with the government and maintain records of customer transactions. Moreover, the Japanese government has recently strengthened its monitoring of financial activities due to concerns raised by the Financial Action Task Force. Notably, Europe’s new Markets in Crypto-Assets bill also mandates the collection of customer information for every transfer.

Furthermore, Japan’s revised Payment Services Act recognizes payments made with registered stablecoins. In a recent paper from the Hong Kong University of Technology, experts proposed the creation of a stablecoin backed by the Hong Kong dollar as an alternative to the dominance of US dollar reserves held by the central bank. Stablecoins play a crucial role in bridging the gap between traditional finance and the world of cryptocurrencies.

In line with these regulatory developments, Binance, a prominent cryptocurrency exchange, has launched a compliant local platform set to onboard all Japanese users starting from December 1, 2023.

Japan’s proactive stance on crypto regulations demonstrates its commitment to foster a secure and regulated environment for the growing cryptocurrency industry. These initiatives aim to strike a balance between innovation and investor protection, paving the way for the continued development and adoption of digital assets in Japan and beyond.