Bitcoin takes a hit! Experts predict possible drop to fill the CME gap. Key levels: $78K-$72K. Can BTC bounce back? #Bitcoin #CryptoNews #BTCPrice

- Introduction: Understanding Bitcoin’s Price Volatility

- The Context: Bitcoin’s Historical Price Movements and CME Gaps

- Main Insights on Bitcoin’s Price Dynamics

- Challenges in Predicting Bitcoin’s Market Behavior

- The Future Outlook: What Lies Ahead for Bitcoin?

- Final Reflections on Bitcoin’s Price Dynamics

Introduction: Understanding Bitcoin’s Price Volatility

Bitcoin, the flagship cryptocurrency, has always been synonymous with volatility. Its price movements often resemble a rollercoaster, capturing the attention of traders, investors, and analysts worldwide. Recently, Bitcoin’s price has taken a significant dip, falling by 10% over the past week, and currently teetering perilously close to the $85,000 mark. This downward trend raises concerns about a potential deeper correction, prompting speculation on the next moves in the crypto market.

As of February 27th, Bitcoin has declined by 3% in just 24 hours. This volatility has sparked debates and analyses about its future trajectory, particularly regarding the filling of a CME gap below $80,000. This article delves into the intricacies of Bitcoin’s current market scenario, exploring the significance of the CME gap, the potential for a deeper correction, and the broader implications for the cryptocurrency market.

The Context: Bitcoin’s Historical Price Movements and CME Gaps

To fully grasp Bitcoin’s current price dynamics, it’s essential to explore its historical price movements and the concept of CME gaps. The Chicago Mercantile Exchange (CME) offers Bitcoin futures, a regulated derivative product popular among institutional investors. Unlike the spot market, which operates 24/7, CME futures have specific trading hours, closing on weekends and holidays. This discontinuity often creates “gaps” on the CME Bitcoin futures chart.

Historically, these gaps have acted as magnets for Bitcoin’s price, often drawing it back over time to “fill” the gaps. This phenomenon is rooted in market psychology and institutional behavior, where gaps are perceived as inefficiencies in pricing that will eventually be corrected. For instance, gaps at $9,700 in 2020 and $35,000 in 2021 were filled months later, typically during periods of consolidation or correction.

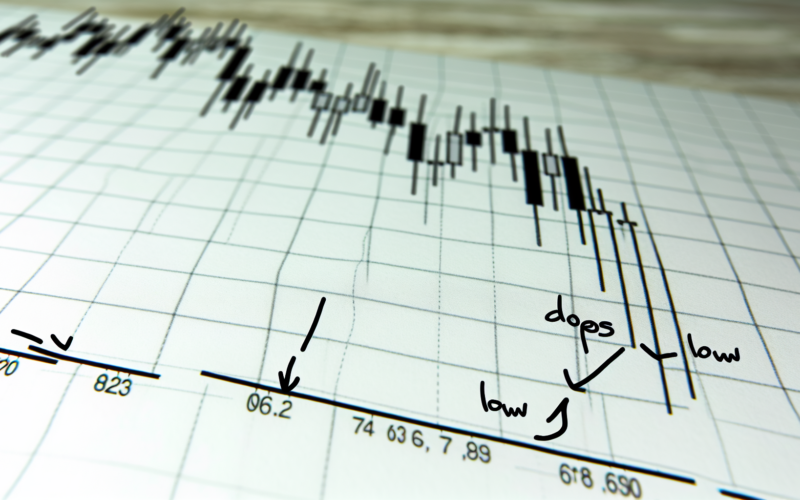

Currently, a CME gap exists below $80,000, as evidenced by the recent price movement. After briefly surging past $90,000 in November 2024, a sell-off left an unfilled gap between approximately $77,930 and $80,670 on the CME chart. This gap aligns with Bitcoin’s 200-day exponential moving average (EMA), reinforcing it as a key support area.

Main Insights on Bitcoin’s Price Dynamics

The Role of CME Gaps in Bitcoin’s Price Correction

CME gaps play a crucial role in understanding Bitcoin’s price dynamics. These gaps, often viewed as price inefficiencies, have historically influenced Bitcoin’s trajectory. The current gap below $80,000 has become a focal point for market analysts and traders. As Bitcoin hovers near this critical level, the potential for filling the gap looms large.

Technical analysts argue that Bitcoin may revisit this zone to close the gap before resuming any sustained upward trend. This notion is supported by historical data, where similar gaps have been filled during periods of market consolidation. The alignment of the CME gap with Bitcoin’s 200-day EMA further strengthens its significance as a key support area.

Implications of a Potential Deeper Correction

The possibility of a deeper correction in Bitcoin’s price is a topic of intense discussion among market participants. Should Bitcoin fail to hold above the CME gap of around $77,000, it may trigger a more significant downturn. This scenario could see Bitcoin revisiting previous support levels, such as the March 2024 highs above $73,000.

Market participants, including prominent analysts like AlphaBTC, have highlighted the risks associated with Bitcoin’s current price levels. AlphaBTC notes that Bitcoin is “holding on for dear life” after losing support at $85,000. The recent sell-off has seen the asset break below key levels of support, finally filling some of the inefficiencies left from previous price surges.

Key Support and Resistance Levels to Watch

In the event of a deeper correction, several key support and resistance levels come into play. Michael van de Poppe, founder of MN Capital, emphasizes the importance of monitoring these levels. The $72,000 support zone, created during the November 2024 rally following Donald Trump’s victory, is a critical area to watch. Additionally, the $65,000 level and the $58,000 to $60,000 range serve as important demand zones.

Beyond these levels, the August 2024 support level above $52,000 could be Bitcoin’s last line of defense. Market data from platforms like CoinGlass also indicates significant liquidity building up in the lower-$70,000 range, suggesting potential price action in this region.

Challenges in Predicting Bitcoin’s Market Behavior

Predicting Bitcoin’s market behavior is no small feat. The cryptocurrency market is inherently complex, influenced by a myriad of factors ranging from macroeconomic trends to regulatory developments. This complexity poses challenges for traders and analysts alike, as they attempt to forecast Bitcoin’s future price movements.

One of the primary challenges is the unpredictability of market sentiment. Bitcoin’s price is heavily influenced by investor sentiment, which can shift rapidly in response to external events. For instance, geopolitical tensions, regulatory announcements, and technological advancements can all impact market sentiment and, consequently, Bitcoin’s price.

The Impact of Institutional Adoption on Bitcoin’s Price

Institutional adoption has been a significant driver of Bitcoin’s price movements in recent years. As institutional investors increasingly enter the market, their actions can have a profound impact on Bitcoin’s price trajectory. The introduction of regulated products like CME Bitcoin futures has provided institutional investors with a gateway into the cryptocurrency market, driving demand and influencing price dynamics.

However, institutional participation also introduces new challenges. The actions of large institutional players can exacerbate market volatility, as their trades have the potential to move the market significantly. Additionally, the presence of institutional investors often brings increased scrutiny and regulation, which can further influence Bitcoin’s price.

The Future Outlook: What Lies Ahead for Bitcoin?

Emerging Trends and Predictions for Bitcoin

As we look to the future, several emerging trends and predictions for Bitcoin come to the forefront. The continued institutional adoption of Bitcoin is expected to play a significant role in shaping its future trajectory. As more institutions embrace cryptocurrencies as part of their portfolios, the demand for Bitcoin is likely to increase, potentially driving its price higher.

Furthermore, advancements in blockchain technology and the development of decentralized finance (DeFi) applications are expected to impact Bitcoin’s future. These technological innovations have the potential to enhance Bitcoin’s utility and broaden its use cases, further solidifying its position in the financial ecosystem.

The Potential for Regulatory Developments

Regulatory developments remain a key consideration for Bitcoin’s future. As governments and regulatory bodies worldwide grapple with the rise of cryptocurrencies, the regulatory landscape is likely to evolve. The introduction of clear and consistent regulations could provide a more stable environment for Bitcoin, encouraging further adoption and investment.

However, regulatory uncertainty also poses risks. Stricter regulations or unfavorable policies could hinder Bitcoin’s growth and adoption, impacting its price. As such, market participants must remain vigilant and adapt to the evolving regulatory landscape.

Final Reflections on Bitcoin’s Price Dynamics

In conclusion, Bitcoin’s current price dynamics reflect the intricate interplay between market psychology, institutional behavior, and external factors. The potential for a deeper correction looms large, driven by the presence of a CME gap and key support levels. However, the future trajectory of Bitcoin is influenced by a multitude of factors, including institutional adoption, regulatory developments, and technological advancements.

As Bitcoin continues to evolve, market participants must remain informed and adaptable. The cryptocurrency market is inherently volatile, and understanding the nuances of Bitcoin’s price dynamics is crucial for making informed investment decisions. Ultimately, Bitcoin’s journey is a testament to the transformative potential of cryptocurrencies and their role in reshaping the financial landscape.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.