**THORChain’s swap volume surges past $1B amid Bybit hack frenzy, with North Korean links revealed. Can THORChain address illicit activity?** #THORChain #CryptoNews #Hacking

- Introduction

- Dynamic Context Section

- Main Insights on THORChain

- Dynamic Challenges Section

- Dynamic Future Outlook

- Final Reflections on THORChain

Introduction

THORChain’s Crosschain Revolution: Understanding the Surge in Swap Volume

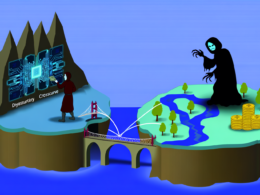

In the rapidly evolving world of cryptocurrency, the sheer dynamism and unpredictability often leave even seasoned enthusiasts on the edge of their seats. One such recent development that has caught the community’s attention is the unprecedented surge in swap volumes on THORChain, a crosschain swap protocol. This surge, largely attributed to the aftermath of the Bybit hack, marks a significant milestone in the decentralized finance (DeFi) space. As we navigate this complex landscape, it becomes crucial to understand the factors driving this surge, the implications for the broader crypto ecosystem, and what it means for stakeholders involved.

On February 26, 2023, THORChain recorded a staggering $859.61 million in swaps, its highest-ever daily volume, as per data from THORChain Explorer. The momentum didn’t stop there; the following day added another $210 million, pushing the total swap volume past $1 billion in under 48 hours. This dramatic increase is not just a testament to THORChain’s capabilities but also a reflection of the growing demand for secure and efficient crosschain transactions.

The intricacies of this surge are deeply intertwined with the $1.4 billion exploit of cryptocurrency exchange Bybit. Such incidents highlight the persistent vulnerabilities within centralized exchanges, prompting users to seek refuge in decentralized solutions like THORChain. This article delves into the mechanics of THORChain’s operations, explores the impact of recent hacks on its activity, and examines the role of state-sponsored hacking groups in shaping the current crypto landscape. Join us as we unpack the complexities of THORChain’s rise and its implications for the future of crosschain swaps.

Dynamic Context Section

The Rise of THORChain: From Concept to Crosschain Powerhouse

THORChain’s journey from a nascent idea to a pivotal player in the cryptocurrency world is a story of innovation, resilience, and strategic foresight. Founded with the vision of enabling seamless crosschain asset swaps, THORChain has continually pushed the boundaries of what’s possible in decentralized finance. The protocol operates without the need for wrapped tokens or synthetic assets, allowing users to exchange native assets across different blockchains directly. This innovation has placed THORChain at the forefront of the DeFi movement, offering a decentralized alternative to traditional exchanges.

The recent surge in THORChain’s swap volumes is closely tied to the Bybit hack, an event that underscored the vulnerabilities of centralized exchanges. Bybit, a prominent player in the crypto exchange space, fell victim to a $1.4 billion exploit, reportedly orchestrated by the North Korean state-sponsored hacking group Lazarus. This group has a notorious history of siphoning funds from crypto platforms and laundering them through various channels, including decentralized exchanges like THORChain.

In the wake of the Bybit hack, many users turned to THORChain for its ability to facilitate quick and anonymous swaps. The protocol’s design inherently supports privacy, making it an attractive option for those looking to obscure the trail of stolen assets. As a result, THORChain witnessed an influx of swap activity, propelling its daily volumes to record highs.

The current scenario underscores the critical role that decentralized platforms play in the crypto ecosystem. As centralized exchanges continue to grapple with security challenges, protocols like THORChain offer a viable alternative, emphasizing the need for decentralized, trustless solutions. This section explores the historical context of THORChain’s development, its response to growing demand, and the broader implications for the DeFi landscape.

Main Insights on THORChain

The Mechanics of THORChain: Revolutionizing Crosschain Transactions

THORChain’s unique approach to crosschain swaps sets it apart in the DeFi space, offering a seamless mechanism for exchanging assets across different blockchains. At its core, THORChain employs a decentralized liquidity protocol that connects multiple chains, including Bitcoin, Ethereum, Binance Chain, and others, without the need for intermediaries. This section breaks down the key components that make THORChain a revolutionary platform for crosschain transactions.

- Decentralized Liquidity Pools: Central to THORChain’s functionality are its liquidity pools, which allow users to provide liquidity in exchange for a share of the transaction fees. By incentivizing liquidity provision, THORChain ensures there is sufficient depth in its pools to facilitate large swaps without significant slippage. This decentralized model not only democratizes access to liquidity but also enhances the protocol’s resilience against market fluctuations.

- The Role of RUNE: THORChain’s native cryptocurrency, RUNE, plays a pivotal role in the ecosystem, acting as a settlement asset and a means of securing the network. RUNE’s value proposition extends beyond mere transactional utility; it also functions as a governance token, enabling holders to participate in decision-making processes and influence the protocol’s direction. The recent surge in swap volumes has positively impacted RUNE’s price, underscoring its integral role in THORChain’s success.

- Security and Privacy Considerations: While THORChain offers robust security features, the surge in swap volume following the Bybit hack has raised concerns about the potential misuse of the platform for illicit activities. THORChain’s team has been proactive in addressing these issues, implementing measures to enhance transaction monitoring and working with wallet and integration partners to screen for suspicious activities. These efforts aim to strike a balance between privacy and compliance, ensuring that THORChain remains a trusted platform for legitimate users.

- User Experience and Accessibility: THORChain’s focus on user experience is evident in its intuitive interface and streamlined process for conducting swaps. The protocol’s integration with various wallets and decentralized applications (dApps) further enhances accessibility, making it easier for users to tap into crosschain liquidity. This commitment to user-centric design has contributed to THORChain’s growing popularity, attracting both novice and experienced crypto enthusiasts.

As THORChain continues to expand its reach and refine its offerings, its impact on the DeFi landscape is undeniable. By providing a decentralized alternative to traditional exchanges, THORChain is not only fostering innovation but also empowering users to take control of their financial assets. This section delves into the mechanics of THORChain’s operations, examining the factors that have propelled its rise and the challenges it faces in maintaining its momentum.

Dynamic Challenges Section

Overcoming Hurdles: Addressing Security and Compliance in THORChain’s Ecosystem

Despite its innovative approach and growing popularity, THORChain faces several challenges that could impact its long-term sustainability. As the platform navigates the complexities of crosschain transactions, it must contend with issues related to security, compliance, and scalability. This section explores the specific hurdles THORChain must overcome to solidify its position in the DeFi ecosystem.

- Security Vulnerabilities: The recent surge in swap volumes, driven by the Bybit hack, has brought security concerns to the forefront. While THORChain’s decentralized model offers inherent protections against some types of attacks, the platform remains vulnerable to sophisticated exploits. Ensuring the integrity of liquidity pools and safeguarding user funds are critical priorities that require ongoing vigilance and innovation.

- Compliance and Regulatory Pressure: As decentralized exchanges gain traction, they increasingly attract the attention of regulators worldwide. THORChain must navigate the delicate balance between offering privacy features and complying with anti-money laundering (AML) regulations. Implementing effective compliance measures without compromising user privacy is a complex challenge that requires careful consideration and collaboration with industry stakeholders.

- Scalability and Network Congestion: The surge in activity on THORChain has highlighted the need for scalable solutions that can accommodate growing demand without degrading performance. As more users flock to the platform, ensuring that transactions remain fast and cost-effective is essential. THORChain’s development team is actively exploring solutions to enhance the protocol’s scalability, including optimizing network architecture and expanding liquidity pools.

- Market Competition: The DeFi space is highly competitive, with numerous platforms vying for dominance in the crosschain swap market. THORChain must differentiate itself by continually innovating and delivering value to its users. Building strategic partnerships, expanding its supported asset list, and enhancing user experience are key strategies that can help THORChain maintain its competitive edge.

Addressing these challenges is crucial for THORChain’s continued growth and success. By proactively tackling security, compliance, and scalability issues, THORChain can reinforce its position as a leader in decentralized finance, paving the way for a more secure and accessible crypto ecosystem.

Dynamic Future Outlook

Charting the Path Forward: The Future of Crosschain Swaps and THORChain’s Role

As the cryptocurrency landscape continues to evolve, the future of crosschain swaps holds immense potential. THORChain, with its innovative approach and growing user base, is well-positioned to play a pivotal role in shaping this future. This section explores the emerging trends and opportunities that lie ahead for THORChain and the broader DeFi ecosystem.

- Expanding Crosschain Capabilities: The demand for crosschain swaps is expected to grow as more blockchain networks emerge and users seek to diversify their portfolios. THORChain’s ability to facilitate seamless transactions across multiple chains positions it as a key player in this expanding market. As the protocol continues to evolve, enhancing its crosschain capabilities and supporting additional networks will be crucial to capturing new opportunities.

- Integration with Traditional Finance: The convergence of decentralized finance and traditional financial systems presents exciting possibilities for THORChain. By integrating with financial institutions and offering innovative solutions for crossborder transactions, THORChain can bridge the gap between crypto and fiat, driving mainstream adoption and unlocking new use cases.

- Enhancing Security and Privacy: As regulatory scrutiny intensifies, platforms like THORChain will need to prioritize security and privacy enhancements to maintain user trust. Implementing advanced cryptographic techniques, such as zero-knowledge proofs, can help balance the need for privacy with regulatory compliance, ensuring that THORChain remains a trusted platform for all users.

- Community and Ecosystem Development: The success of THORChain is closely tied to the strength and engagement of its community. Fostering a vibrant ecosystem of developers, users, and partners will be instrumental in driving innovation and sustaining growth. By supporting community-driven initiatives and encouraging collaboration, THORChain can continue to build a robust and resilient network.

The future of crosschain swaps is bright, and THORChain is poised to lead the way. By embracing innovation, addressing challenges, and seizing new opportunities, THORChain can redefine the DeFi landscape and shape the future of decentralized finance.

Final Reflections on THORChain

Key Takeaways from THORChain’s Surge: Lessons for the Crypto Ecosystem

As we reflect on THORChain’s remarkable surge in swap volumes, several key lessons and insights emerge that hold significance for the broader crypto ecosystem. This concluding section synthesizes the article’s main points, emphasizing the importance of decentralized solutions, the challenges that lie ahead, and the opportunities for innovation.

THORChain’s recent success underscores the growing demand for decentralized alternatives to traditional exchanges. In the wake of security breaches like the Bybit hack, users are increasingly turning to platforms that offer privacy, efficiency, and resilience. THORChain’s ability to facilitate seamless crosschain transactions without intermediaries highlights the potential of decentralized finance to empower users and enhance financial sovereignty.

However, the path forward is not without challenges. Ensuring robust security measures, navigating regulatory landscapes, and scaling to meet rising demand are critical priorities that require concerted effort and innovation. By addressing these challenges head-on, THORChain can reinforce its position as a leader in the DeFi space and drive the next wave of crypto adoption.

Looking ahead, the future of crosschain swaps presents exciting possibilities for growth and integration. As THORChain continues to expand its capabilities and engage with the broader financial ecosystem, it has the potential to reshape the way we transact and interact with digital assets. By fostering a collaborative and inclusive community, THORChain can unlock new opportunities and pave the way for a more accessible and secure crypto future.

In conclusion, THORChain’s journey is a testament to the power of decentralized innovation and the resilience of the crypto community. As we navigate this dynamic landscape, the lessons learned from THORChain’s surge serve as a guiding light for the future of decentralized finance. Let us embrace the challenges and opportunities that lie ahead, as we work together to build a more equitable and decentralized financial system for all.