Trump’s crypto task force to reveal a strategy for a U.S. Bitcoin reserve, focusing on regulation and not taxpayer funds. Can this make the U.S. a crypto leader? #Crypto #Bitcoin #DigitalAssets

- Introduction: Understanding the Shift Towards Digital Asset Governance

- From Inception to Influence: Tracing the Evolution of U.S. Digital Asset Policies

- Main Insights on Cryptocurrency Integration in U.S. Economic Strategy

- Navigating Challenges: Balancing Innovation and Security in Cryptocurrency Policy

- Future Outlook: Pioneering the Digital Finance Landscape

- Final Reflections on Cryptocurrency’s Role in Economic Policy

Introduction: Understanding the Shift Towards Digital Asset Governance

In recent years, digital assets have transitioned from being perceived as fringe financial instruments to becoming integral components of modern economic strategies. This shift is particularly evident in the United States, where the government has actively engaged in formulating comprehensive digital asset policies. This article explores the implications of President Donald Trump’s digital assets task force report, focusing on the strategic measures proposed to integrate cryptocurrencies like Bitcoin into the national economic framework. We will also delve into expert predictions and the potential impact of these policies on the U.S. and global financial landscapes.

From Inception to Influence: Tracing the Evolution of U.S. Digital Asset Policies

The journey of digital assets in the U.S. began with skepticism, characterized by regulatory uncertainty and fragmented oversight. Initially, cryptocurrencies were primarily associated with illicit activities due to their anonymous nature. However, as their underlying blockchain technology demonstrated potential for secure and efficient transactions, the perspective began to shift.

The pivotal moment came with the establishment of the Presidential Working Group on Digital Asset Markets, tasked with conducting a 180-day review of existing policies and proposing strategic recommendations. This initiative was part of President Trump’s broader vision to position America as a leader in the digital finance revolution. The task force included key figures from the Treasury, SEC, CFTC, DOJ, and other federal agencies, ensuring a holistic approach to policy formulation.

Main Insights on Cryptocurrency Integration in U.S. Economic Strategy

The Role of Bitcoin in National Economic Security

Bitcoin, often dubbed ‘digital gold,’ has emerged as a potential asset for national reserves due to its decentralized nature and limited supply. The task force’s report hints at the feasibility of establishing a federal crypto reserve, leveraging seized digital assets already in government custody. This approach aims to mitigate volatility risks while exploring ways to build a Bitcoin stockpile without burdening taxpayers.

The Impact of Regulatory Clarity on Market Growth

Regulatory clarity is a recurring theme in the task force’s recommendations. By clearly defining token classifications and stablecoin oversight, the report seeks to enhance market integrity and foster investor confidence. This clarity is expected to facilitate smoother interactions between digital asset businesses and regulatory bodies, encouraging innovation and growth within the sector.

Taxation and Enforcement: Ensuring Compliance and Fair Play

Digital asset taxation emerges as a critical focus area, with the report advocating for transparent and consistent taxation policies. The aim is to prevent tax evasion while ensuring that digital asset transactions are subject to the same scrutiny as traditional financial activities. Enforcement clarity is also emphasized, with the report proposing frameworks to combat fraud and protect consumers.

Embracing Stablecoins: A Pragmatic Approach to Digital Currency

Stablecoins, particularly those pegged to the U.S. dollar, are positioned as key instruments in the digital economic strategy. The report underscores the importance of promoting USD-pegged stablecoins while ensuring robust regulatory frameworks to address privacy and trust concerns. This approach aligns with broader international cooperation efforts to standardize digital asset regulations.

Addressing Privacy and Trust in Digital Currency Usage

One of the primary challenges in adopting cryptocurrencies is balancing innovation with privacy and trust. The task force recommends steering clear of retail CBDCs due to potential privacy issues, instead focusing on enhancing the regulatory environment for stablecoins. This strategy aims to foster trust among users and investors, ensuring that digital currencies are secure and reliable.

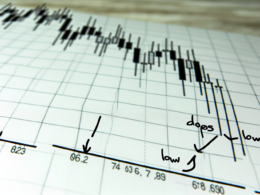

Overcoming Market Volatility and Risk Management

The inherent volatility of cryptocurrencies poses significant challenges to their integration into national reserves. The report suggests a cautious approach, advocating for mechanisms to manage risks associated with market fluctuations. This includes exploring hedging strategies and leveraging advanced analytics to predict market trends and mitigate potential losses.

Future Outlook: Pioneering the Digital Finance Landscape

Emerging Trends in Cryptocurrency Adoption

The report envisions a future where cryptocurrencies play a central role in global finance, with the U.S. leading the charge in innovation and standardization. As digital assets become more mainstream, we can expect increased collaboration between governments and private sectors to develop infrastructure that supports their widespread use.

The Strategic Implications of a Federal Crypto Reserve

The concept of a federal crypto reserve is poised to redefine national monetary policies. By integrating digital assets into the economic framework, the U.S. could enhance its financial resilience and adaptability in the face of global economic shifts. This forward-thinking approach positions the country as a potential trailblazer in the digital finance revolution.

Final Reflections on Cryptocurrency’s Role in Economic Policy

In conclusion, the strategic integration of cryptocurrencies into U.S. economic policy represents a significant shift towards embracing digital finance. The task force’s report offers a roadmap for leveraging digital assets to enhance national security, promote innovation, and ensure regulatory compliance. As the global digital economy continues to evolve, the U.S. stands at the forefront of shaping the future of finance, setting precedents that will influence international policies and practices. By navigating challenges and seizing opportunities, America is poised to become a global leader in the digital finance arena, paving the way for a more inclusive and resilient economic future.