Binance shifts $1B SAFU fund to Bitcoin, raising protection questions amid crypto volatility. How will this impact users? #Bitcoin #Binance #CryptoNews

- Introduction: Understanding the Shift in Binance’s SAFU Strategy

- The Context: From Stablecoins to Bitcoin

- Main Insights on Binance’s Transition to Bitcoin

- Challenges in Transitioning SAFU to Bitcoin

- Future Outlook: What Lies Ahead for Binance’s SAFU Strategy

- Final Reflections on Binance’s SAFU Transition

Introduction: Understanding the Shift in Binance’s SAFU Strategy

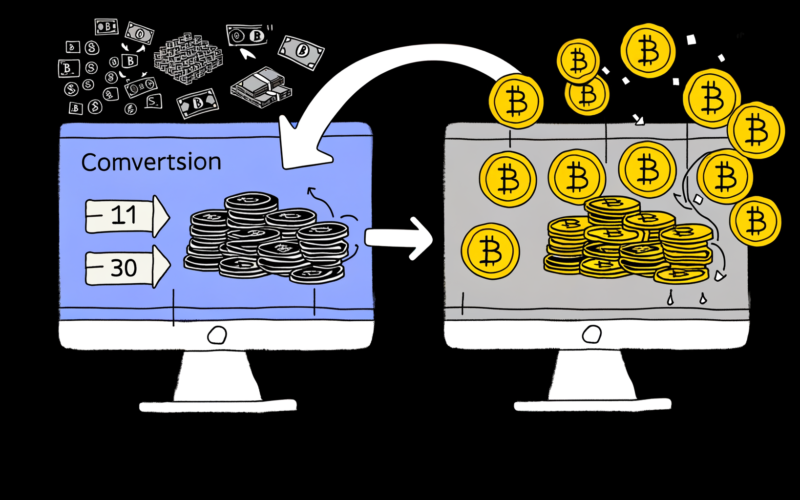

In a significant strategic shift, Binance, one of the world’s leading cryptocurrency exchanges, has announced the reallocation of its Secure Asset Fund for Users (SAFU) from stablecoins to Bitcoin. This move reflects Binance’s growing conviction that Bitcoin is not just a trading asset but the core long-term asset of the crypto ecosystem. The decision raises important questions about user protection and the potential risks associated with exposing the fund to Bitcoin’s price volatility. This article delves into the implications of this shift, providing insights into Binance’s strategy and its potential impact on the crypto industry.

The Context: From Stablecoins to Bitcoin

The History of SAFU and Its Role in User Protection

SAFU was launched in 2018 as an insurance-style fund, funded by a portion of Binance’s trading fees, to protect users in extreme cases such as hacks or platform failures. Over the years, SAFU has played a critical role in maintaining user trust, especially in incidents like the 2019 hack where Binance reimbursed users for losses using the SAFU fund.

The Evolution of SAFU’s Asset Composition

Initially, SAFU’s reserves were denominated in Binance’s branded stablecoin, BUSD, ensuring the fund’s liquidity and reliability. However, in 2024, the fund’s stablecoin component was shifted from BUSD to USDC, following the wind-down of BUSD. This move was intended to maintain the fund’s US dollar-pegged stability. The latest decision to transition SAFU’s reserves entirely into Bitcoin marks a significant departure from this strategy, aligning the fund with what Binance now considers the industry’s primary long-term store of value.

Main Insights on Binance’s Transition to Bitcoin

Binance’s Rationale: Bitcoin as the Core Long-Term Asset

In an open letter to the crypto community, Binance framed this shift as an expression of its belief in Bitcoin’s long-term value. Unlike stablecoins, which are often pegged to fiat currencies, Bitcoin is decentralized and considered a hedge against inflation. This perspective positions Bitcoin as a more sustainable and resilient asset in the face of economic uncertainties.

The Potential Risks: Exposure to Bitcoin’s Price Volatility

While Bitcoin offers long-term value, its price is notoriously volatile. By reallocating SAFU to Bitcoin, Binance introduces the risk of significant value fluctuations in its user protection fund. This raises concerns about the fund’s ability to provide adequate coverage in the event of a major security breach or insolvency event, especially during a sharp Bitcoin drawdown.

Risk Mitigation Strategies: Binance’s Commitment to User Protection

To address these concerns, Binance has committed to rebalancing the SAFU fund back up to $1 billion if market volatility drives its value below $800 million. Additionally, Binance has pledged to use its treasury reserves to top up the fund as needed, ensuring that user protection remains a top priority.

The Broader Implications for the Crypto Industry

Binance’s decision to shift SAFU’s reserves to Bitcoin could set a precedent for other exchanges and financial institutions. It highlights the growing acceptance of Bitcoin as a core asset and may influence how other entities structure their reserves and insurance funds in the future.

Challenges in Transitioning SAFU to Bitcoin

One of the primary challenges Binance may face is navigating regulatory and compliance requirements. As cryptocurrencies like Bitcoin face increasing scrutiny from regulators worldwide, Binance must ensure that its SAFU strategy aligns with legal and compliance standards.

Balancing User Trust and Financial Stability

Another challenge lies in balancing user trust with financial stability. Binance must reassure users that their funds are secure despite the inherent volatility of Bitcoin. This requires transparent communication and robust risk management practices to maintain confidence in the exchange.

Addressing Public Perception and Market Sentiment

The shift to Bitcoin may also impact public perception and market sentiment. Binance must manage potential concerns from users and investors who may question the prudence of exposing SAFU to Bitcoin’s volatility. Engaging with the community and providing clear, concise information will be crucial in addressing these concerns.

Future Outlook: What Lies Ahead for Binance’s SAFU Strategy

Emerging Trends and Predictions

As Binance continues to embrace Bitcoin as a core asset, it may explore additional strategies to enhance user protection and fund stability. This could include diversifying SAFU’s asset composition with other cryptocurrencies or exploring innovative financial instruments to hedge against Bitcoin’s volatility.

The Role of Technology in Enhancing User Protection

Advancements in blockchain technology and decentralized finance (DeFi) could play a significant role in enhancing user protection. Binance may leverage these technologies to create more resilient and transparent user protection mechanisms, further strengthening SAFU’s capabilities.

The Potential Impact on the Crypto Ecosystem

Binance’s bold move could have ripple effects throughout the crypto ecosystem. As more exchanges and financial institutions consider similar strategies, the role of Bitcoin in financial reserves and user protection funds may continue to grow, reinforcing its status as a foundational asset in the digital economy.

Final Reflections on Binance’s SAFU Transition

Key Takeaways and Lessons Learned

Binance’s decision to transition SAFU to Bitcoin underscores the exchange’s confidence in Bitcoin’s long-term value and its commitment to user protection. However, it also highlights the challenges and risks associated with such a strategy, particularly in navigating regulatory requirements and managing public perception.

The Importance of Strategic Risk Management

Effective risk management will be crucial in ensuring the success of SAFU’s transition to Bitcoin. Binance must continue to engage with regulators, communicate transparently with users, and implement robust risk management practices to maintain trust and stability.

Looking Forward: The Future of User Protection in Crypto

As the crypto industry evolves, user protection will remain a top priority for exchanges and financial institutions. Binance’s SAFU transition could serve as a catalyst for innovation in user protection strategies, paving the way for more resilient and adaptable financial systems in the digital age.

In conclusion, Binance’s shift of SAFU to Bitcoin represents a bold and strategic move that reflects the exchange’s vision for the future of the crypto ecosystem. While it presents challenges and risks, it also offers opportunities for growth and innovation in user protection. As Binance navigates this transition, it will be essential to balance the need for financial stability with the evolving demands of the crypto industry and its users.