🚨 CrossCurve Faces $3M Exploit! 🚨 Identified addresses linked to the hack, CrossCurve warns of legal action without fund return. #CryptoNews #Blockchain #DeFi

- Understanding the CrossCurve Security Breach: An Overview

- The Rise and Evolution of CrossChain Bridges in DeFi

- Analyzing the CrossCurve Exploit: What Went Wrong?

- Legal Repercussions and CrossCurve’s Strategic Response

- Future of DeFi Security: Challenges and Opportunities

- Looking Ahead: What Lies in Store for CrossCurve and DeFi?

- Final Reflections on CrossCurve’s Journey: Lessons and Insights

Understanding the CrossCurve Security Breach: An Overview

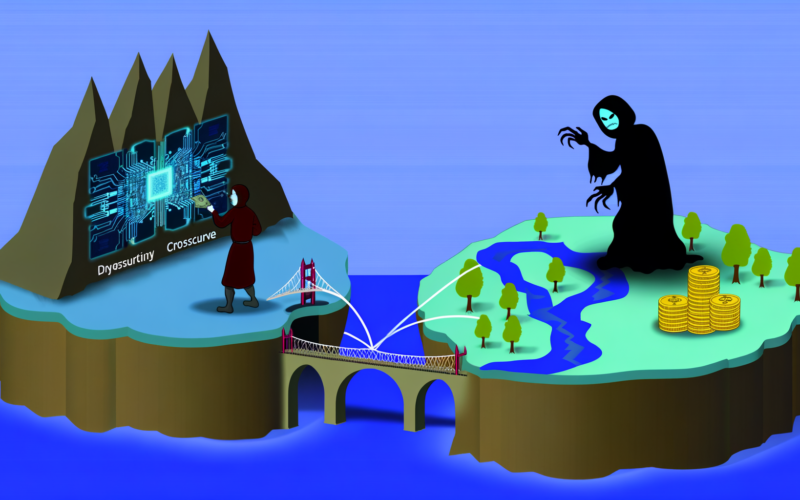

In the ever-evolving landscape of decentralized finance (DeFi), security remains a paramount concern. The recent incident involving CrossCurve, formerly known as EYWA, highlights the vulnerabilities that can arise within the intricate systems of cross-chain bridges. On a seemingly ordinary Sunday, CrossCurve’s token transfer system fell prey to an exploit that siphoned approximately $3 million. This breach has not only raised alarms about the security of smart contracts but also prompted CrossCurve to consider drastic legal measures to reclaim its losses and safeguard its users. This article delves into the details of the exploit, the immediate reactions from CrossCurve, and the broader implications for the DeFi community.

The Rise and Evolution of CrossChain Bridges in DeFi

The concept of cross-chain bridges is integral to the DeFi ecosystem, allowing seamless token transfers between different blockchain networks. These bridges facilitate interoperability, enabling users to leverage the unique features of multiple blockchains without being confined to one. However, with great power comes great responsibility—and risk. The evolution of cross-chain technology has been marked by significant milestones, from the early days of rudimentary token swaps to sophisticated systems like CrossCurve’s that promise efficiency and security. Yet, as the CrossCurve incident illustrates, the journey is fraught with challenges.

Analyzing the CrossCurve Exploit: What Went Wrong?

The Mechanics of the Exploit

At the heart of the CrossCurve exploit was a vulnerability in one of its smart contracts. Smart contracts, the self-executing programs on blockchains, are designed to automate transactions based on predefined rules. However, the flaw in CrossCurve’s contract allowed an attacker to bypass critical validation checks, sending a fake cross-chain message that tricked the bridge into releasing funds. Blockchain security firm BlockSec identified this lack of validation as the exploit’s root cause, noting that the cross-chain messages were not adequately verified, leading to a catastrophic breach.

Identifying the Perpetrators

In the wake of the attack, CrossCurve’s response was swift. CEO Boris Povar announced the identification of ten Ethereum addresses linked to the exploit, stressing that these addresses received the stolen funds. While Povar initially expressed belief in the absence of malicious intent, the absence of communication or fund return within a stipulated 72-hour window would result in the assumption of malicious intent, triggering legal action.

The Impact on the DeFi Ecosystem

The exploit’s ramifications extend beyond CrossCurve, casting a shadow over the entire DeFi landscape. It underscores the fragility of cross-chain bridges, which, despite their potential, remain susceptible to sophisticated attacks. The incident also serves as a grim reminder of the high stakes involved in DeFi, where billions of dollars are at risk of being compromised.

Legal Repercussions and CrossCurve’s Strategic Response

Pursuing Legal Action: A Deterrent or a Necessity?

Faced with a significant financial loss and potential reputational damage, CrossCurve has signaled its intent to pursue both criminal and civil actions against the exploiters. The company’s strategy includes coordinating with exchanges to freeze the compromised assets, publicly disclosing the offending wallets, and enlisting the aid of law enforcement and blockchain analytics firms. Such measures, while drastic, underscore the seriousness with which CrossCurve views the breach and its commitment to protecting its users.

The Broader Legal Landscape for DeFi

CrossCurve’s legal maneuvers highlight a growing trend within the DeFi sector: the increasing reliance on traditional legal systems to address digital grievances. As DeFi continues to mature, the intersection of decentralized technology and centralized legal frameworks will become increasingly pivotal. This incident may set a precedent for how similar cases are handled in the future, potentially shaping the regulatory environment for DeFi projects.

Future of DeFi Security: Challenges and Opportunities

Enhancing Smart Contract Security

In light of the CrossCurve exploit, the focus on improving smart contract security has never been more critical. Blockchain security experts emphasize the need for rigorous validation processes and the development of robust auditing tools to prevent such vulnerabilities. Additionally, the incident has prompted discussions about the potential of using multi-layered security protocols to fortify cross-chain bridges.

The Role of Community and Collaboration

As DeFi continues to evolve, the importance of community-driven security measures cannot be overstated. Collaborative efforts between projects, security firms, and users are essential to identify vulnerabilities and develop proactive solutions. CrossCurve’s incident serves as a call to action for the DeFi community to prioritize security and work collectively to safeguard the ecosystem.

Looking Ahead: What Lies in Store for CrossCurve and DeFi?

Anticipating Regulatory Changes

The CrossCurve exploit may act as a catalyst for regulatory scrutiny within the DeFi space. As governments and regulatory bodies become more aware of the risks associated with DeFi, there may be an increased push for standardized security protocols and regulatory compliance.

The Potential for Technological Innovation

Despite the challenges, the CrossCurve incident presents an opportunity for innovation. Developers and projects are likely to explore new technologies and methodologies to enhance security and trust within the DeFi ecosystem. This could lead to the emergence of more resilient cross-chain solutions that balance efficiency with robust security measures.

Final Reflections on CrossCurve’s Journey: Lessons and Insights

The CrossCurve exploit serves as a stark reminder of the challenges inherent in the DeFi landscape. It underscores the need for vigilance, innovation, and collaboration in addressing security vulnerabilities. As CrossCurve navigates the aftermath of the breach, its actions and strategies may offer valuable lessons for other projects within the DeFi ecosystem. By prioritizing security and fostering a culture of transparency and accountability, the DeFi community can work towards a more secure and resilient future.

In conclusion, while the CrossCurve incident has exposed vulnerabilities, it has also highlighted the resilience and adaptability of the DeFi sector. As projects like CrossCurve continue to evolve, the lessons learned from such incidents will be instrumental in shaping a more secure and trustworthy DeFi ecosystem for all stakeholders.