Democratic senators question DOJ Deputy AG’s crypto holdings amid rollback in enforcement. Can conflict-of-interest laws impact crypto regulation? #Crypto #DOJ #Ethics

- Introduction: The Intersection of Crypto and Ethics in Government

- The Journey of Crypto Regulation: From Innovation to Scrutiny

- Main Insights on Blanche’s Case: Ethical Dilemmas and Regulatory Challenges

- Breaking Barriers: Challenges in Ethical Crypto Governance

- The Future of Crypto Regulation: Navigating New Frontiers

- Final Reflections on Ethical Crypto Governance: Lessons and Insights

Introduction: The Intersection of Crypto and Ethics in Government

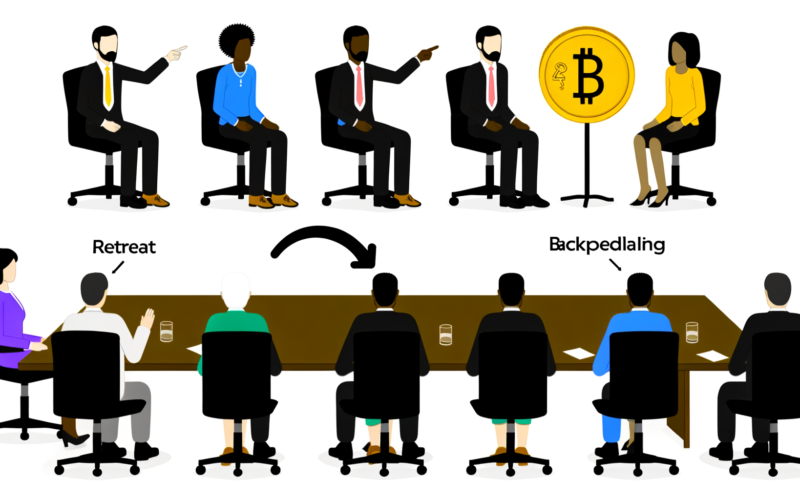

In recent years, the intertwining of cryptocurrency and governmental policies has sparked significant debate. As digital assets continue to gain prominence, their influence reaches even the highest echelons of power. A recent controversy involving Deputy Attorney General Todd Blanche has brought this issue to the forefront. Blanche has been accused by six Democratic senators of violating conflict-of-interest laws by rolling back crypto enforcement while maintaining substantial digital holdings. This complex scenario not only underscores the growing impact of cryptocurrency on legal frameworks but also raises pertinent questions about ethics and transparency in government. This article delves into the intricacies of this case, exploring the broader implications for crypto regulation and public trust.

The Journey of Crypto Regulation: From Innovation to Scrutiny

Cryptocurrencies have come a long way from their inception as an alternative financial system. Initially perceived as a fringe technology, Bitcoin and its ilk have gradually infiltrated mainstream financial markets and regulatory frameworks. The journey of crypto regulation has been marked by milestones that reflect the evolving understanding and acceptance of digital assets.

Early Days: Bitcoin’s Rise and Initial Skepticism

Bitcoin, launched in 2009, was initially met with skepticism. Governments and financial institutions were wary of a decentralized currency that operated outside traditional banking systems. However, as Bitcoin gained traction, its potential to revolutionize transactions and offer a hedge against inflation became apparent. This shift in perception set the stage for regulatory bodies to start paying attention.

Regulatory Milestones: From Ambiguity to Clarity

As Bitcoin and other cryptocurrencies gained popularity, regulators worldwide began to grapple with how to categorize and oversee them. The lack of a centralized authority initially posed challenges, but over time, significant milestones were achieved. Countries like Japan recognized Bitcoin as legal tender, while the U.S. Securities and Exchange Commission (SEC) started classifying certain tokens as securities. These developments marked a shift from ambiguity to a more structured approach to crypto regulation.

The Advent of Enforcement: Balancing Innovation and Security

With the rise in crypto’s popularity, regulatory bodies began focusing on enforcement to curb illicit activities like money laundering and fraud. The establishment of the National Cryptocurrency Enforcement Team in the U.S. was a testament to this effort. However, the balance between promoting innovation and ensuring security remains a delicate one. Blanche’s case highlights the challenges authorities face in navigating this complex landscape.

Main Insights on Blanche’s Case: Ethical Dilemmas and Regulatory Challenges

The allegations against Deputy Attorney General Todd Blanche center around potential conflicts of interest and ethical breaches. These accusations bring to light several critical insights into the intersection of personal financial interests and public responsibility.

Understanding the Allegations: Conflicts of Interest and Legal Implications

At the heart of the allegations is the claim that Blanche violated 18 U.S.C. § 208(a), which prohibits federal officials from participating in decisions that could affect their personal financial interests. By holding significant cryptocurrency assets while influencing crypto enforcement policies, Blanche’s actions have raised questions about impartiality and ethics in government.

The Role of Financial Disclosures: Transparency and Accountability

The senators’ letter to Blanche underscores the importance of financial disclosures in maintaining transparency and accountability among public officials. Blanche’s financial interests in Bitcoin and Ethereum, which ranged between $158,000 and $470,000, were disclosed, yet the timing and nature of his divestment have sparked concerns. This situation highlights the need for stricter regulations and clearer guidelines on asset disclosure to prevent conflicts of interest.

Implications for Crypto Regulation: Balancing Innovation and Oversight

Blanche’s case exemplifies the broader challenges regulators face in overseeing the rapidly evolving crypto landscape. The decision to disband the National Cryptocurrency Enforcement Team and ease oversight has drawn criticism, with concerns that it may enable illicit activities. This situation emphasizes the need for a balanced approach that fosters innovation while safeguarding public interests.

The Ethical Debate: Public Trust and Government Accountability

The ethical debate surrounding Blanche’s case extends beyond the crypto sector. It raises questions about public trust in government institutions and the accountability of officials in positions of power. As cryptocurrencies continue to reshape financial systems, maintaining ethical standards and transparency becomes paramount to ensuring public confidence in regulatory bodies.

Breaking Barriers: Challenges in Ethical Crypto Governance

The case involving Deputy Attorney General Todd Blanche sheds light on the challenges inherent in ethical crypto governance. As digital assets continue to reshape financial landscapes, regulators must address several key obstacles to ensure effective oversight.

One of the primary challenges in ethical crypto governance is navigating conflicts of interest. The dynamic nature of cryptocurrencies and their potential for substantial financial gains create opportunities for conflicts to arise. Public officials must tread carefully, ensuring that personal financial interests do not compromise their ability to make impartial decisions.

Ensuring Transparency: The Role of Financial Disclosures

Transparency is a cornerstone of effective governance. Blanche’s case highlights the importance of comprehensive financial disclosures to prevent conflicts of interest. Regulators must establish clear guidelines on asset disclosure, ensuring that public officials are accountable for their financial holdings and potential influences on policy decisions.

Balancing Innovation and Regulation: A Delicate Equilibrium

The rapid evolution of cryptocurrencies presents a challenge for regulators seeking to balance innovation with oversight. While fostering technological advancements is crucial, maintaining robust regulatory frameworks is equally important. Blanche’s case underscores the need for regulatory bodies to adapt swiftly to emerging technologies while safeguarding public interests.

Building Public Trust: Restoring Confidence in Regulatory Institutions

Public trust in regulatory institutions is vital for effective governance. Blanche’s case has raised questions about the integrity of government officials and their ability to regulate cryptocurrencies impartially. Restoring public confidence requires a commitment to transparency, accountability, and ethical standards, ensuring that regulatory bodies act in the best interests of the public.

As the cryptocurrency landscape continues to evolve, regulators face the challenge of navigating new frontiers. The future of crypto regulation will likely be shaped by emerging trends and technological advancements that demand innovative approaches to governance.

Embracing Technological Advancements: The Role of Blockchain in Regulation

Blockchain technology, the backbone of cryptocurrencies, holds immense potential for enhancing regulatory frameworks. Its decentralized and transparent nature can facilitate more efficient and secure oversight. Regulators must explore ways to leverage blockchain’s capabilities to streamline compliance processes and enhance transparency in financial transactions.

Collaborative Approaches: International Cooperation in Crypto Regulation

Cryptocurrencies transcend geographical boundaries, necessitating international cooperation in regulation. Collaborative efforts among governments and regulatory bodies can help establish uniform standards and prevent regulatory arbitrage. The future of crypto regulation will likely involve increased collaboration to address global challenges and ensure consistent oversight.

Adapting to Emerging Trends: The Rise of Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a rapidly growing sector within the crypto industry that presents unique regulatory challenges. DeFi platforms operate without traditional intermediaries, raising questions about how to ensure consumer protection and prevent illicit activities. Regulators must develop innovative approaches to address the complexities of DeFi while fostering its potential for financial inclusion.

Promoting Ethical Standards: Building a Culture of Integrity in Crypto Governance

As cryptocurrencies gain prominence, promoting ethical standards in governance becomes increasingly important. Regulatory bodies must prioritize transparency, accountability, and integrity to build public trust. Blanche’s case serves as a reminder of the need for ethical conduct in crypto regulation, ensuring that public officials act in the best interests of society.

Final Reflections on Ethical Crypto Governance: Lessons and Insights

The case of Deputy Attorney General Todd Blanche offers valuable lessons on the complexities of ethical crypto governance. As cryptocurrencies continue to reshape financial landscapes, regulators must navigate challenges and embrace opportunities to ensure effective oversight.

Key Takeaways: Balancing Innovation and Oversight

The balance between fostering innovation and maintaining robust oversight is crucial in the crypto industry. Blanche’s case underscores the importance of finding equilibrium, ensuring that regulatory frameworks support technological advancements while safeguarding public interests.

The Need for Transparency: Enhancing Accountability in Governance

Transparency is a fundamental pillar of effective governance. Comprehensive financial disclosures and clear guidelines on asset holdings are essential to prevent conflicts of interest and maintain public trust in regulatory institutions.

Collaborative Efforts: Shaping the Future of Crypto Regulation

International cooperation and collaborative approaches are vital for addressing the global challenges posed by cryptocurrencies. By working together, regulators can establish consistent standards and ensure effective oversight across borders.

Building a Culture of Integrity: Promoting Ethical Standards in Crypto Governance

Promoting ethical standards and integrity in crypto governance is paramount for building public trust. Blanche’s case serves as a reminder of the need for ethical conduct among public officials, ensuring that regulatory bodies act in the best interests of society.

As the crypto industry continues to evolve, embracing these lessons and insights will be crucial for navigating the complexities of ethical crypto governance and ensuring a sustainable future for digital assets.