Bitcoin traders brace for volatility as BTC navigates new range economy; will bulls support momentum amidst weekend uncertainties? #Bitcoin #CryptoTrading #BTCMarket

- Introduction: Understanding Bitcoin’s Current Price Fluctuations

- The Historical Context of Bitcoin’s Price Volatility

- Main Insights on Bitcoin’s Current Price Dynamics

- Challenges in Navigating Bitcoin’s Volatile Landscape

- Future Outlook: What Lies Ahead for Bitcoin?

- Final Reflections on Bitcoin’s Price Volatility

Introduction: Understanding Bitcoin’s Current Price Fluctuations

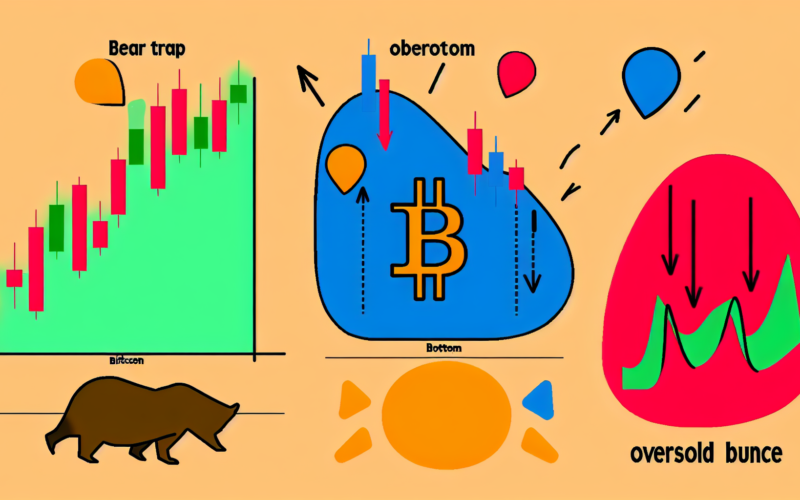

In the ever-evolving world of cryptocurrency, Bitcoin remains a focal point for traders and investors alike. Recently, Bitcoin’s price activity has caught the attention of market participants due to a significant double-digit drawdown, shaking the confidence of those who hoped for a steady climb. As Bitcoin’s price bounces around the $78,300 to $85,000 range, traders are left wondering: what’s next for this digital asset? This article seeks to unravel the complexities behind Bitcoin’s current price movements, providing insights into the dynamics at play and what they might mean for the future of Bitcoin trading.

The Historical Context of Bitcoin’s Price Volatility

Bitcoin’s Journey Through Price Peaks and Valleys

To understand Bitcoin’s current price behavior, it’s crucial to reflect on its historical volatility. Since its inception, Bitcoin has experienced numerous cycles of dramatic rises and falls. These cycles, often characterized by rapid gains followed by sharp corrections, are not new to seasoned traders. For instance, the 2017 bull run saw Bitcoin reach nearly $20,000 before tumbling down to around $3,200 in 2018. Such patterns are part and parcel of Bitcoin’s nature, driven by a combination of market speculation, regulatory developments, and macroeconomic factors.

The Role of Market Sentiment and External Events

Bitcoin’s price is heavily influenced by market sentiment and significant global events. For example, comments from influential figures or regulatory announcements can trigger rapid price movements. Recently, remarks from former President Trump regarding cryptocurrency have added another layer of uncertainty, contributing to the choppy price action. Understanding these external influences is key to navigating Bitcoin’s volatile landscape.

Main Insights on Bitcoin’s Current Price Dynamics

The Technical Perspective: Analyzing Bitcoin’s Price Patterns

From a technical analysis standpoint, Bitcoin’s current price action reflects a classic range-bound trading scenario. According to crypto trader Magus, Bitcoin is likely to establish a trading range between $72,000 and $85,000 in the coming weeks. This range-building phase is characterized by the lack of strong spot demand and the inability to secure a higher high candlestick for a daily close, which are critical indicators of market strength.

The Influence of Spot and Futures Markets

The interplay between spot and futures markets plays a significant role in Bitcoin’s price dynamics. Data from TRDR.io indicates that Bitcoin received a strong spot bid at Coinbase when the price dipped to $78,300. However, the sustainability of this momentum hinges on whether bulls can generate enough purchasing volume. The futures market, with its leverage-driven nature, can amplify price movements and contribute to the volatility witnessed during these periods.

The Psychological Aspect: Trader Sentiment and Market Psychology

Beyond technical factors, trader sentiment and market psychology are pivotal. The recent 29% drawdown from Bitcoin’s all-time high of $110,000, while substantial, is not unprecedented. Historical data shows that 30% corrections are common during Bitcoin bull markets, often presenting buying opportunities for those with a long-term view. Understanding this cyclical nature and maintaining a level-headed approach can help traders make informed decisions in a volatile market.

The Impact of Regulatory Uncertainty

Regulatory developments continue to pose challenges for Bitcoin traders. As governments worldwide grapple with how to regulate cryptocurrencies, uncertainty remains a significant factor influencing Bitcoin’s price. The lack of clear regulatory guidelines can lead to abrupt market reactions, as seen in past instances where regulatory announcements have triggered sharp sell-offs.

The Threat of Market Manipulation

Market manipulation remains a concern in the cryptocurrency space. The relatively low liquidity compared to traditional financial markets makes Bitcoin susceptible to price manipulation by large players, known as whales. These entities can execute substantial trades that significantly impact market prices, creating an additional layer of complexity for traders aiming to navigate Bitcoin’s choppy waters.

Future Outlook: What Lies Ahead for Bitcoin?

Emerging Trends and Predictions

Looking ahead, several trends could shape Bitcoin’s future. The increasing institutional adoption of cryptocurrency and the development of decentralized finance (DeFi) platforms are poised to influence Bitcoin’s trajectory. As more institutions recognize Bitcoin as a legitimate asset class, its integration into traditional financial systems could stabilize price volatility over time.

The Potential for Mainstream Adoption

Bitcoin’s potential for mainstream adoption remains a topic of discussion among industry experts. As awareness and understanding of cryptocurrencies grow, Bitcoin’s acceptance as a medium of exchange and store of value could expand. This broader adoption could lead to increased price stability and a more predictable trading environment.

Final Reflections on Bitcoin’s Price Volatility

Key Takeaways for Traders and Investors

In conclusion, Bitcoin’s current price volatility is a reflection of its historical behavior, market dynamics, and external influences. Traders and investors must remain vigilant, understanding the technical, psychological, and regulatory factors at play. While short-term price action may be unpredictable, the long-term potential for Bitcoin remains significant. By approaching this digital asset with a well-informed strategy and a focus on long-term trends, market participants can navigate Bitcoin’s choppy waters with greater confidence.

The Importance of Continuous Learning and Adaptation

As the cryptocurrency landscape evolves, continuous learning and adaptation are essential. Staying informed about market developments, regulatory changes, and technological advancements will empower traders and investors to make informed decisions. With the right approach, Bitcoin’s volatility can be transformed from a challenge into an opportunity for growth and success in the digital age.