Justin Bieber’s $1.3M Bored Ape NFT now worth $12K. Was it a bad investment or just bad timing? #NFTs #Crypto #BoredApeYachtClub

- Introduction

- From Hype to Reality: The Rise and Fall of the Bored Ape Yacht Club

- Main Insights on the NFT Market

- Navigating NFT Market Volatility: Risks and Considerations

- The Future of NFTs: Emerging Trends and Predictions

- Final Reflections on NFTs

Introduction

Exploring the NFT Phenomenon: Insights into Bieber’s Bored Ape Investment

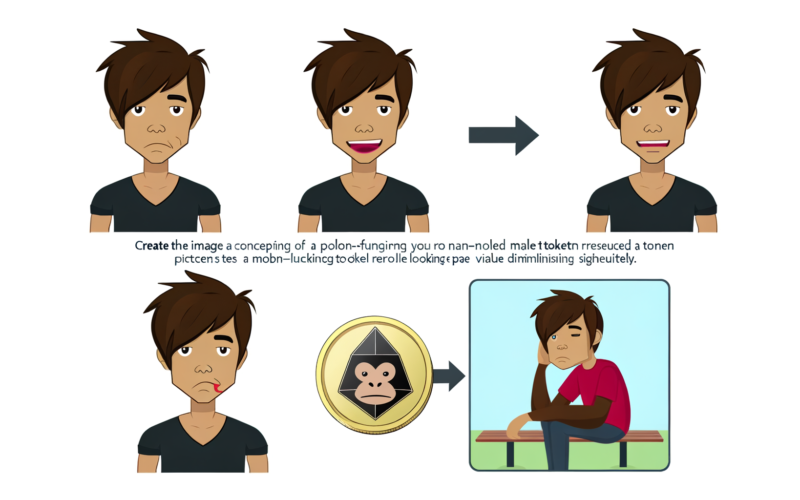

In the whirlwind world of digital assets, few stories capture the essence of the NFT craze quite like Justin Bieber’s high-profile purchase of a Bored Ape Yacht Club NFT. In January 2022, amidst the height of NFT mania, Bieber made headlines by spending 500 ETH, approximately $1.3 million at the time, on a Bored Ape NFT. Fast forward to today, and the same asset is valued at a mere $12,000, illustrating the volatile nature of digital collectibles. This article delves into the dynamics of the NFT market, the factors influencing asset valuation, and the broader implications of Bieber’s investment journey. We’ll explore the rise and fall of the Bored Ape Yacht Club, the challenges of NFT investments, and the future outlook of this intriguing digital frontier.

From Hype to Reality: The Rise and Fall of the Bored Ape Yacht Club

The Bored Ape Yacht Club (BAYC) emerged as a cultural phenomenon in the NFT space, captivating the attention of celebrities and investors alike. Launched in April 2021 by Yuga Labs, BAYC offered a collection of 10,000 unique digital apes with varying traits and attributes. These NFTs quickly became a symbol of status and exclusivity, with their appeal rooted in the community-driven aspect of ownership, where holders gained access to exclusive events and benefits. The project’s success was fueled by a combination of celebrity endorsements, social media buzz, and the growing interest in digital art and collectibles.

During the initial boom, the Bored Ape Yacht Club’s floor price—representing the lowest price at which an NFT from the collection could be purchased—soared, reaching heights of up to $429,000 in April 2022. This meteoric rise was part of a broader NFT frenzy, where digital assets were being traded at unprecedented prices, driven by scarcity, uniqueness, and the speculative nature of the market.

However, the rapid ascent was followed by an equally swift decline. As the NFT hype subsided, the market experienced a correction, with floor prices plummeting across various collections, including BAYC. The decline was exacerbated by broader market factors, such as shifts in cryptocurrency values, regulatory scrutiny, and changing investor sentiment. This context sets the stage for understanding how Bieber’s significant investment in a Bored Ape NFT could lose such a substantial portion of its value in a relatively short span.

Main Insights on the NFT Market

1. The Celebrity Effect: How Stars Influence NFT Valuations

Celebrities like Justin Bieber have played a pivotal role in the NFT market, often driving prices and interest through their endorsements and purchases. The allure of owning an asset associated with a major public figure can inflate NFT values, at least temporarily. Bieber’s investment in a Bored Ape NFT exemplifies this phenomenon, as his purchase brought significant attention to the collection, contributing to its initial surge in value. However, the celebrity effect is a double-edged sword, as it can also lead to inflated valuations that may not be sustainable in the long term.

2. Understanding NFT Valuation: Beyond the Hype

The valuation of NFTs is influenced by a myriad of factors beyond celebrity ownership. These include the uniqueness and rarity of the asset, the reputation and track record of the creators, and the broader trends within the cryptocurrency and digital art markets. In the case of Bieber’s Bored Ape, the lack of rare traits or attributes made it a “floor” NFT, meaning it was among the least valuable within the collection. As the initial hype waned, the intrinsic value of such NFTs became more apparent, leading to significant price adjustments.

3. The Role of Community and Utility in NFT Success

Successful NFT projects often build strong communities and offer tangible utility to their holders. The Bored Ape Yacht Club capitalized on this by creating a sense of exclusivity and belonging among its members, with perks such as access to private events and collaborations. This aspect of community and utility is crucial in sustaining interest and value in the NFT space. For investors, understanding the long-term utility and community engagement of an NFT project can provide insights into its potential for sustained value.

4. Lessons from the NFT Market: Speculation vs. Long-Term Investment

The NFT market is characterized by its speculative nature, where prices can skyrocket based on trends and hype rather than intrinsic value. Bieber’s experience highlights the risks associated with speculative investments, where significant losses can occur if market conditions change. For investors, distinguishing between speculative opportunities and those with long-term potential is critical. This involves assessing the underlying technology, community, and real-world applications of NFTs, rather than relying solely on celebrity endorsements or market trends.

5. The Impact of Market Corrections on NFT Investments

Market corrections are an inherent part of any investment landscape, and the NFT market is no exception. The dramatic fall in the value of Bieber’s Bored Ape NFT underscores the volatility and unpredictability of digital assets. Such corrections can lead to significant financial losses for investors who entered the market during peak periods. Understanding the cyclical nature of markets and the factors driving corrections can help investors better navigate the NFT space and make informed decisions.

Investing in NFTs presents unique challenges, primarily due to the market’s volatility and the lack of historical data to guide investment decisions. One of the key challenges is the rapid pace of change, where trends can shift dramatically within a short period, affecting asset values. Additionally, the speculative nature of the market means that prices can be influenced by factors that are difficult to predict, such as celebrity endorsements, social media trends, and broader economic conditions.

Another significant challenge is the regulatory environment, which remains uncertain as governments and financial institutions grapple with the implications of digital assets. This uncertainty can impact market confidence and influence the long-term viability of NFT investments. For investors, staying informed about regulatory developments and understanding their potential impact on the NFT ecosystem is crucial.

Finally, the technical complexity of NFTs and blockchain technology can be a barrier for many investors. Understanding the nuances of smart contracts, digital wallets, and the underlying blockchain infrastructure is essential for making informed investment decisions. As the market evolves, investors must be willing to adapt and continuously educate themselves to navigate the complexities of the NFT landscape.

The Future of NFTs: Emerging Trends and Predictions

Despite the challenges and market corrections, the future of NFTs holds significant potential. One of the key trends is the integration of NFTs into mainstream industries, such as gaming, fashion, and entertainment, where they can offer new forms of engagement and monetization. Additionally, the development of metaverse platforms, where NFTs serve as digital assets and identities, presents new opportunities for growth and innovation.

Another emerging trend is the focus on sustainability and the environmental impact of NFTs. As concerns about the carbon footprint of blockchain technology grow, there is increasing interest in developing eco-friendly solutions and platforms. This shift towards sustainability could play a crucial role in shaping the future of the NFT market and attracting environmentally conscious investors.

Furthermore, the evolution of NFT marketplaces and platforms is likely to drive greater accessibility and diversity in the types of assets available. As the market matures, we can expect to see more sophisticated and user-friendly platforms that cater to a wider audience, making NFTs more accessible to both creators and collectors.

Final Reflections on NFTs

Lessons from the NFT Market: Insights for Investors

The story of Justin Bieber’s Bored Ape NFT investment offers valuable lessons for investors navigating the complex world of digital assets. It highlights the importance of understanding the underlying value and utility of NFTs, rather than relying solely on market trends or celebrity influence. Investors must approach the NFT market with a long-term perspective, recognizing the potential for both significant gains and losses.

As the NFT landscape continues to evolve, staying informed and adaptable will be key to success. By focusing on projects with strong community engagement, tangible utility, and sustainable practices, investors can better position themselves to capitalize on the opportunities within this dynamic market. Ultimately, the NFT market represents a new frontier in digital innovation, offering exciting possibilities for those willing to explore its potential.