Investment manager BlackRock filed applications for two crypto funds, only one of which was genuine. The fake application for an XRP Trust caused $6.5 million in liquidations, while the application for an Ethereum ETF pushed the asset’s price up briefly.

Schiff Predicts Early Bitcoin (BTC) Crash

On Thursday, though, investors were eagerly awaiting the US Securities and Exchange Commission’s (SEC) ruling on the approval of spot Bitcoin exchange-traded funds. They were disappointed by the SEC’s decision to defer the ruling.

But social media was abuzz with Bitcoin ETF activity. Earlier in the week, Bitcoin skeptic Peter Schiff asked his X (formerly Twitter) followers when Bitcoin would crash. Respondents to his Twitter poll favored a post-ETF crash, but Schiff disagreed.

“Based on the results, my guess is that Bitcoin crashes before the ETF launch. That is why people who bought the rumor won’t actually profit if they wait for the fact to sell.”

Most respondents chose to buy and HODL, the opposite of Schiff’s view that Bitcoin is “fool’s gold” that does not hedge against inflation.

Bitcoin Halving Could Return 2,500%

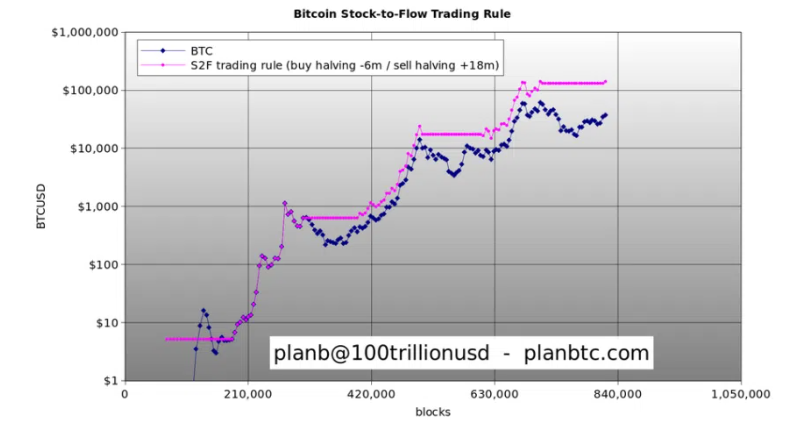

But those who couldn’t care less about ETFs could turn $5 into $130,000 from the Bitcoin halving. That’s according to trading veteran Plan B, who said on Sunday that previous halvings offered returns of 2,500%. The halving next April decreases the Bitcoin emission rate by 50%.

To stand a chance of reaping these gains, traders should buy Bitcoin six months prior to the halving and sell 18 months later. But BitMEX CEO Arthur Hayes argued that it is better to go long on Bitcoin because it performed better than US Treasuries during the Russia-Ukraine war.

“The smartest trade is going long crypto. There is nothing else that has outperformed the increase in bank balance sheets like crypto.”

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Ripple XRP Liquidations Top $6 Million

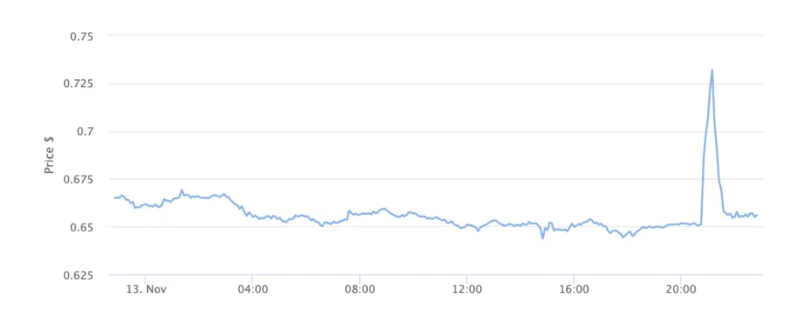

But long XRP investors suffered massively after a BlackRock filing for a Ripple XRP Trust in Delaware turned out to be false. Data provider CoinGlass showed over $6 million in liquidations after a notice allegedly filed by a BlackRock director came up on a state website.

BlackRock confirmed the filing was fake, but there is uncertainty about how it happened. It could have been a scam or a poor filing. The price of XRP rose 12.4% (see chart below) but fell back after that.

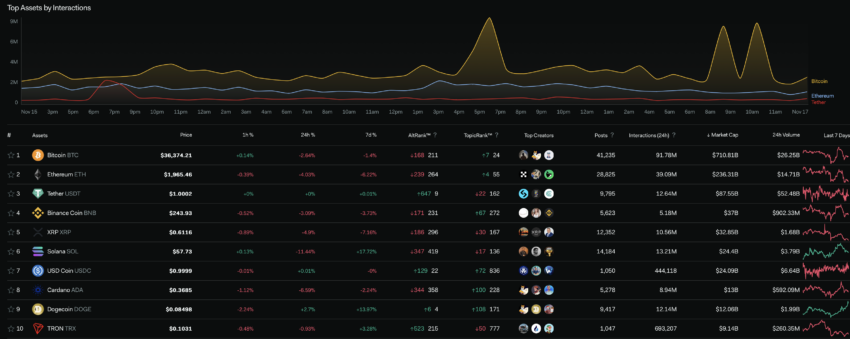

Crypto – Socially Speaking

China Web3 Ambitions in Full View

Stepping away from the chaos in the US for a bit, a Chinese board game company, Boyaa, committed $100 million to buy Bitcoin, Ethereum, USDC, and Tether amid a push to bring its legacy expertise into Web 3. It wants to explore digital asset interaction and how to improve online gaming.

This is a significant move since Hong Kong has favored Web3 for some time. The move could also take advantage of Asian play-to-earn communities that trade in-game items over blockchain.

Read more: Top 5 Web3 Use Cases: Where Web3 Is, Where It’s Going

Cardano Devs Promote New Tool

The Cardano development team, meanwhile, has been hard at work. The team announced Monday it is building a tool that will give developers efficient access to Cardano blockchain data.

Previously, developers could only access blocks sequentially, a process that becomes infeasible as the network grows. The Cardano Foundation confirmed the network has over nine million blocks.

“Cardano, for instance, currently has more than 9.5 million blocks minted on mainnet.”

Cardano leads global blockchain development activity and is ahead of Polkadot and Kusama. The new tool will be built using the high-level programming language called Java.

Top 10 Crypto Performers This Week

DISCLAIMER

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.